Control How You Handle Taxes

With a powerful tax system, you'll be able to control how you handle taxes on every level.

- Control the tax rate on a customer level

- Control the tax rate on a product level

- Control the tax rate on a country level

- Control the tax rate on a state level

- Handle EU tax rules such as OSS and reverse charge.

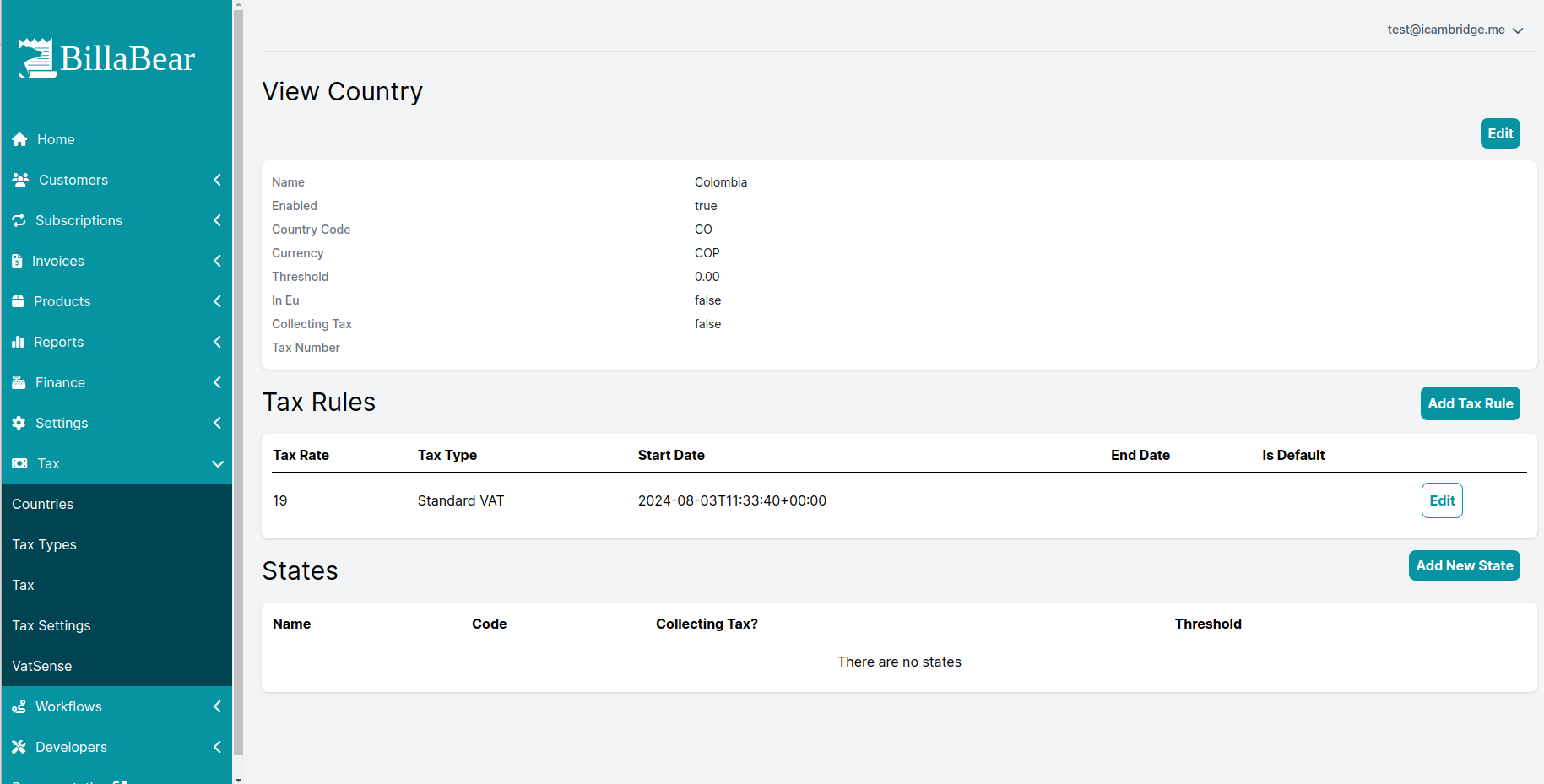

Manage Your Taxes With Dynamic Rules

With the ability to create tax rules via the UI you're able to quickly and easily control which tax rates are being applied.

Tax laws don't change often but when they do they cause companies a lot of pain. With the ability to create new rules with validity dates, you can be prepared for tax changes without a lot of drama and work.

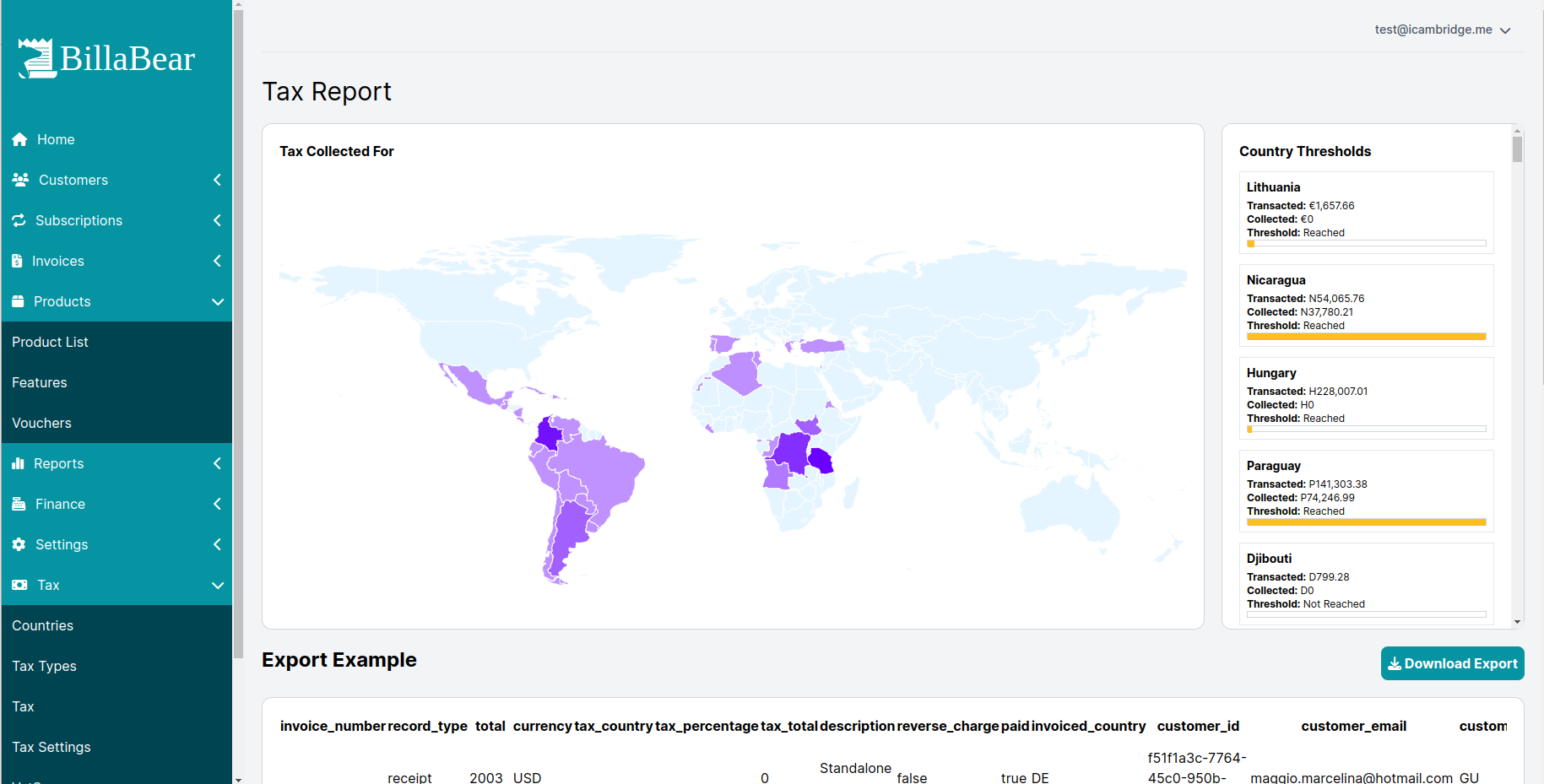

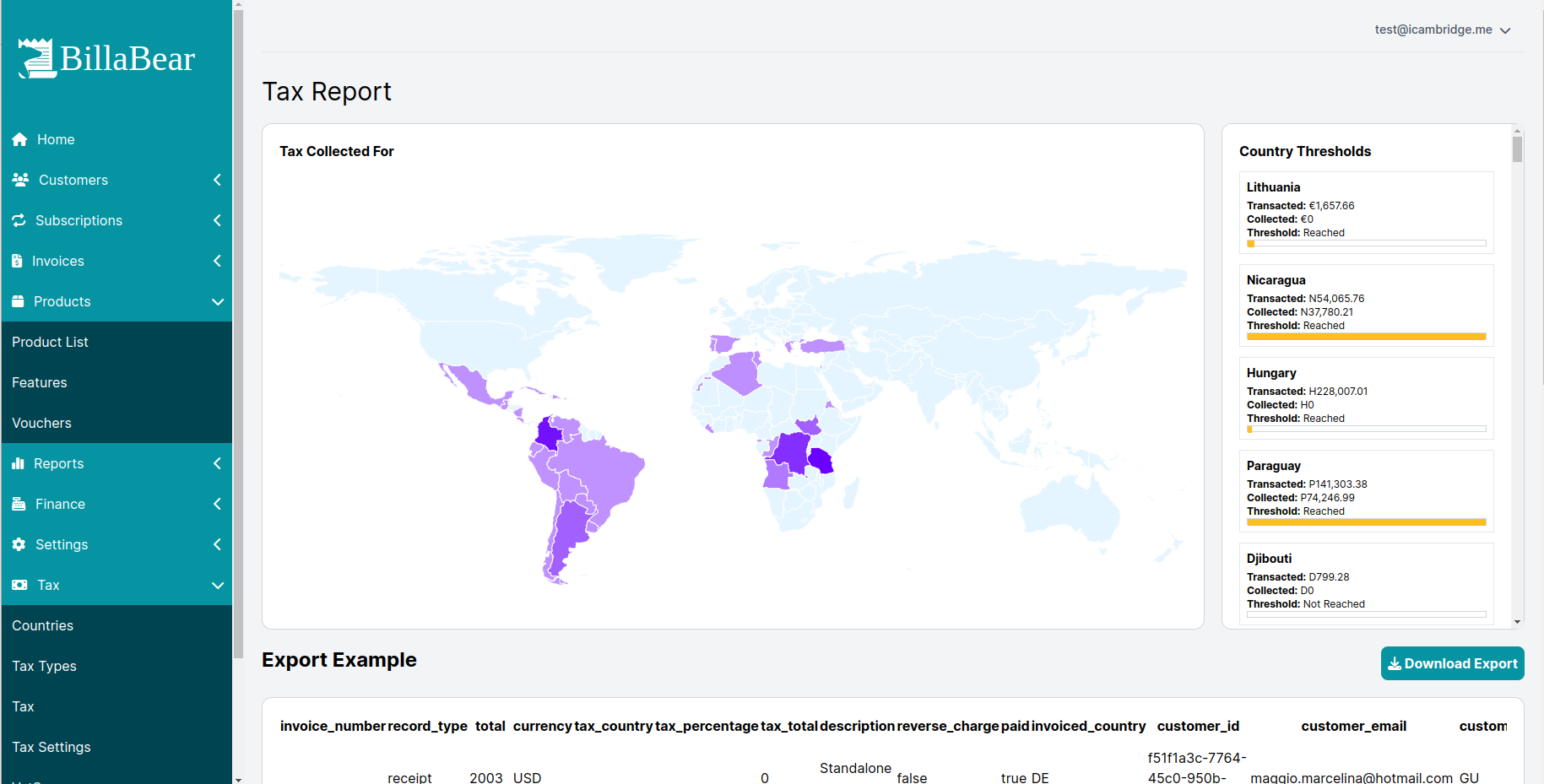

See Your Tax Collection At A Glance

With a quick glance at the tax report map, you're able to see which countries you've collected taxes for and how much. See how close you are to reaching tax thresholds for countries with the threshold amount and the transacted amount listed out for each country where you've had a transaction from.

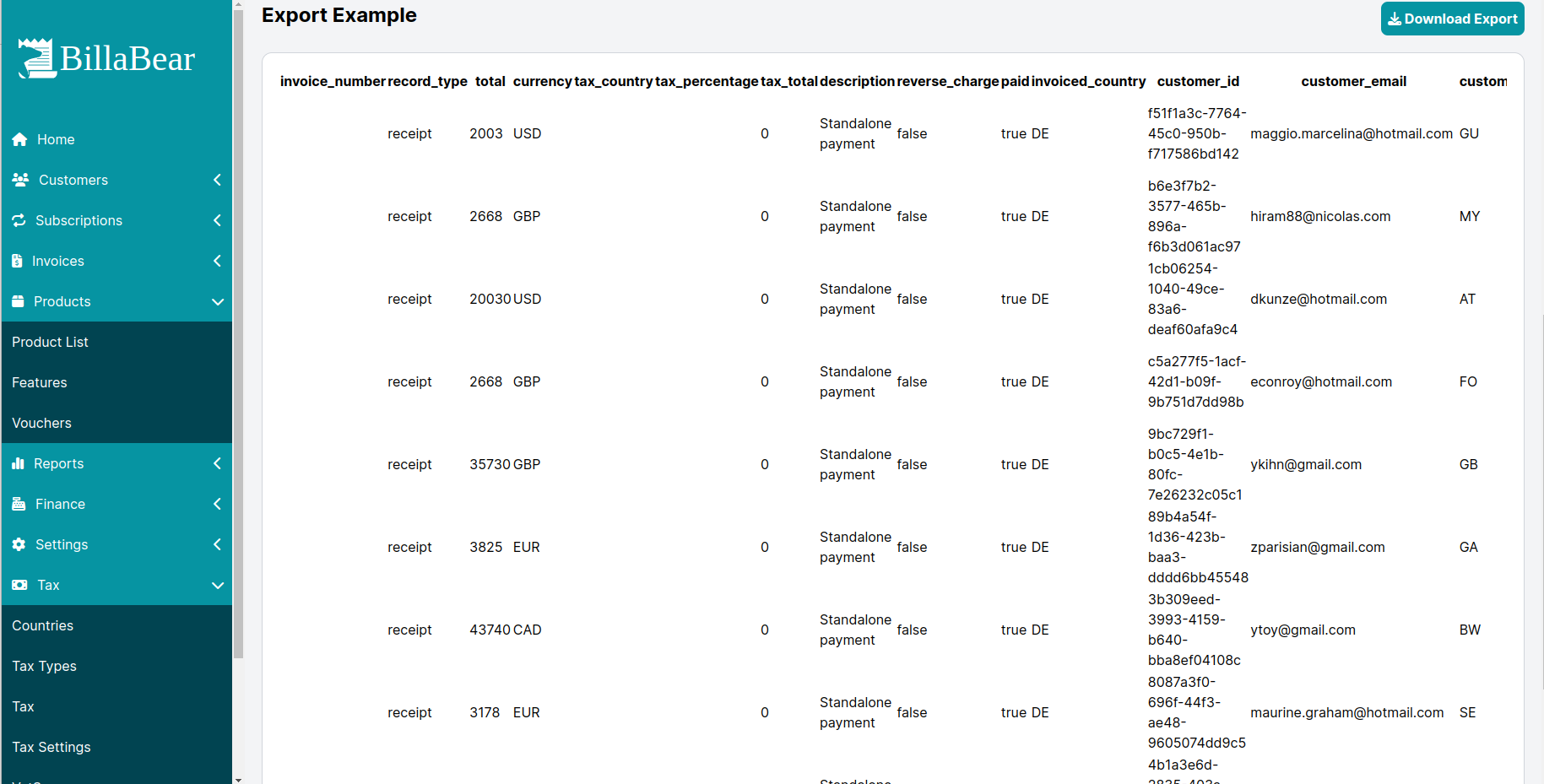

Quick And Easy Exports

Easily export your payment information with a click of a button. You'll be able to easily provide your finance experts with the data they need within minutes.

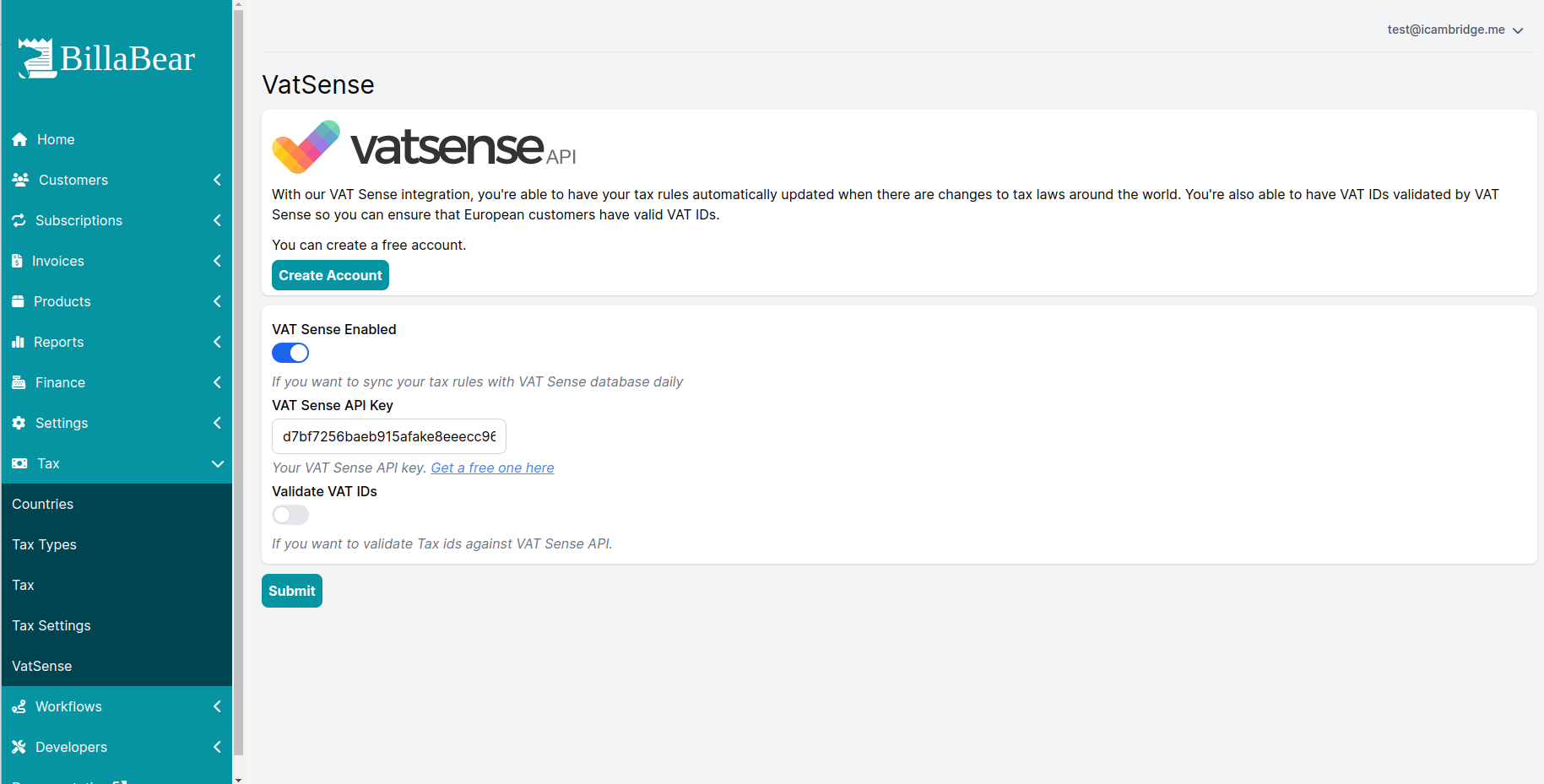

Automate Tax Rules With VAT Sense

Automate the maintenance of your tax rules with VAT Sense. With the VAT Sense integration, BillaBear will check daily if the tax rules have changed and if they have BillaBear will automatically create a new tax rule.